The Best Strategy To Use For Kam Financial & Realty, Inc.

Table of ContentsThe 5-Minute Rule for Kam Financial & Realty, Inc.The Best Guide To Kam Financial & Realty, Inc.The Best Guide To Kam Financial & Realty, Inc.The Facts About Kam Financial & Realty, Inc. Revealed6 Easy Facts About Kam Financial & Realty, Inc. DescribedKam Financial & Realty, Inc. Things To Know Before You Buy

A home mortgage is a finance used to acquire or keep a home, story of land, or other real estate.Home loan applications undertake a strenuous underwriting process before they get to the closing stage. Home mortgage kinds, such as standard or fixed-rate car loans, vary based upon the borrower's requirements. Mortgages are financings that are used to acquire homes and various other kinds of realty. The property itself functions as security for the funding.

The price of a home loan will certainly depend on the kind of lending, the term (such as three decades), and the rates of interest that the loan provider costs. Home loan prices can vary commonly relying on the sort of product and the certifications of the candidate. Zoe Hansen/ Investopedia Individuals and organizations use home mortgages to get genuine estate without paying the entire purchase price upfront.

The smart Trick of Kam Financial & Realty, Inc. That Nobody is Discussing

The majority of conventional home mortgages are completely amortized. This indicates that the regular payment quantity will certainly remain the exact same, yet different percentages of primary vs. rate of interest will be paid over the life of the financing with each repayment. Regular home mortgage terms are for 15 or 30 years. Home mortgages are additionally referred to as liens against residential or commercial property or cases on residential or commercial property.

A property homebuyer promises their residence to their lender, which then has an insurance claim on the residential or commercial property. This makes sure the lender's interest in the residential property ought to the buyer default on their economic responsibility. When it comes to foreclosure, the loan provider may kick out the citizens, offer the residential or commercial property, and make use of the cash from the sale to pay off the home mortgage financial obligation.

The lender will ask for evidence that the customer can repaying the loan. This may consist of bank and investment declarations, current tax returns, and proof of current employment. The lending institution will usually run a credit report check . If the application is authorized, the lending institution will supply the customer a funding of approximately a specific amount and at a certain rates of interest.

Kam Financial & Realty, Inc. Fundamentals Explained

Being pre-approved for a home loan can offer purchasers a side in a tight real estate market since vendors will certainly recognize that they have the cash to back up their deal. As soon as a buyer and seller agree on the regards to their bargain, they or their representatives will fulfill at what's called a closing.

The vendor will move ownership of the home to the buyer and receive the agreed-upon sum of money, and the buyer will certainly sign any kind of remaining home mortgage papers. The lending institution might charge fees for coming from the financing (sometimes in the form of factors) at the closing. There are hundreds of options on where you can obtain a home mortgage.

The smart Trick of Kam Financial & Realty, Inc. That Nobody is Discussing

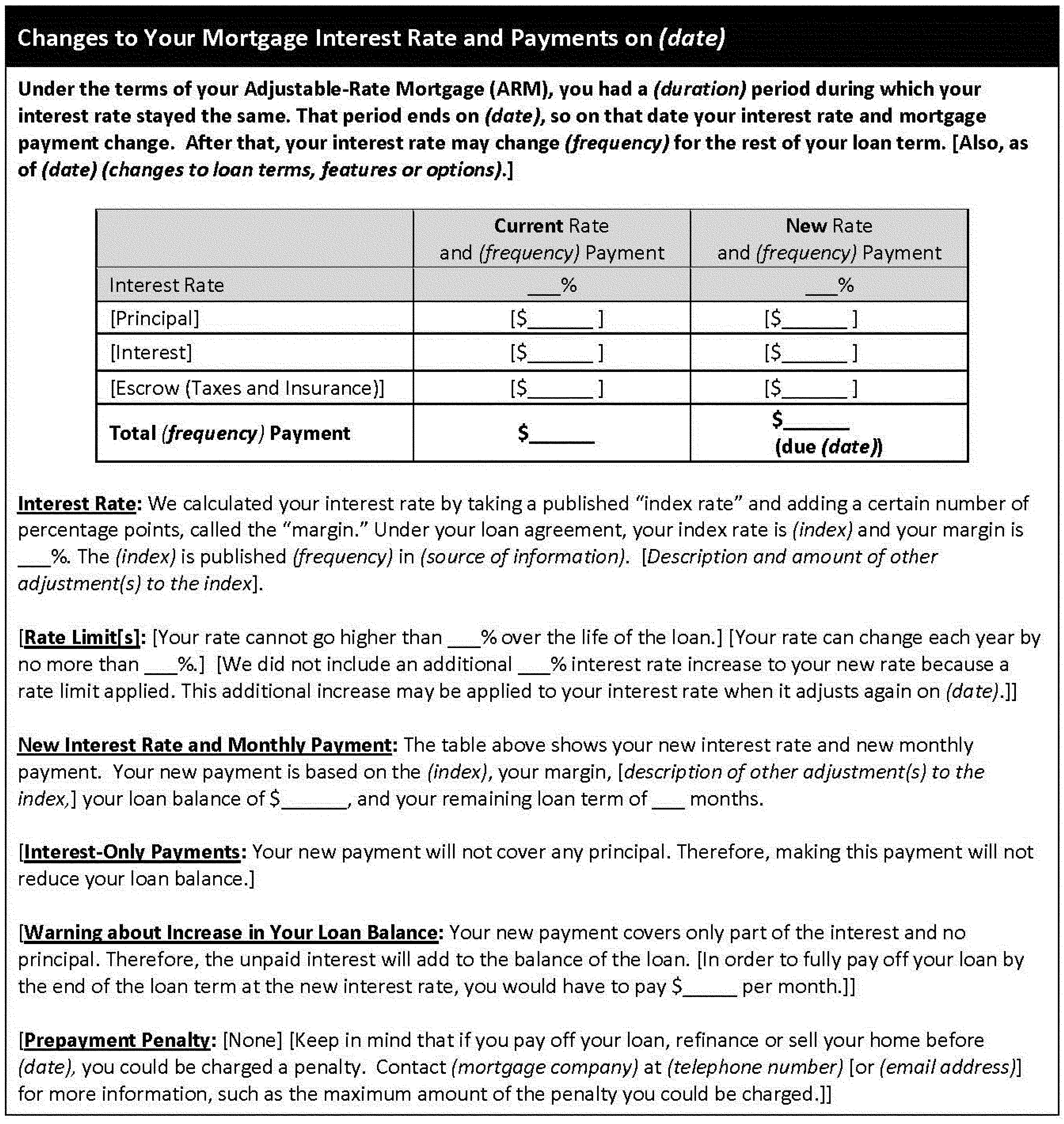

The common sort of home loan is fixed-rate. With a fixed-rate mortgage, the rates of interest remains the same for the entire regard to the lending, as do the customer's regular monthly repayments towards the mortgage. A fixed-rate mortgage is also called a traditional home loan. With an adjustable-rate mortgage (ARM), the passion price is taken care of for a preliminary term, after which it can alter occasionally based on prevailing rates of interest.

The Best Strategy To Use For Kam Financial & Realty, Inc.

The entire lending equilibrium comes to be due when the customer passes away, relocates away completely, or sells the home. Within each sort of mortgage, borrowers have the option to purchase discount factors to buy their interest price down. Factors are essentially a charge that consumers pay up front to have a reduced rate of interest over the life of their funding.

Kam Financial & Realty, Inc. Fundamentals Explained

Exactly how a lot you'll need to pay for a home mortgage depends on the kind (such as repaired or adjustable), its term (such as 20 or 30 years), any kind of discount rate factors paid, and the rate of interest prices at the time. california mortgage brokers. Rates of interest can differ from week to week and from loan provider to lending institution, so it pays to look around

If you default and confiscate on your mortgage, however, the financial institution may end up being the new owner of your home. The cost of a home is frequently far above the amount of cash that many households save. Consequently, home mortgages enable individuals and households to acquire a home by taking down just a relatively tiny down repayment, such as 20% of the purchase cost, and getting a car loan for the balance.